25+ Debt to equity calculator

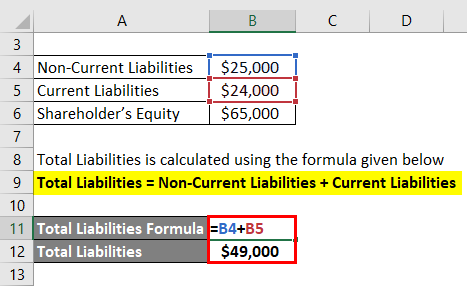

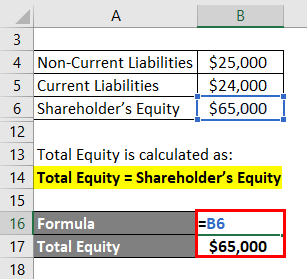

To use this online calculator for Debt to Equity Ratio enter Total Liabilities TL Total Shareholders Equity TSE and hit the calculate button. Firstly calculate the total liabilities of the company by summing up all the liabilities which is available in the balance sheet.

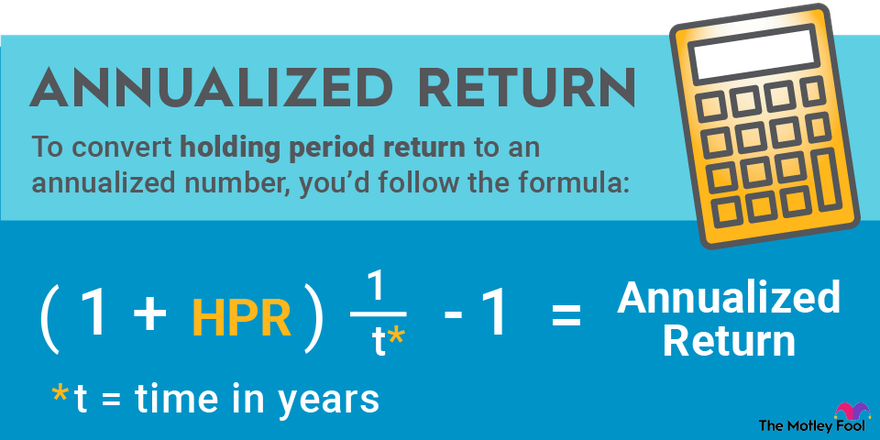

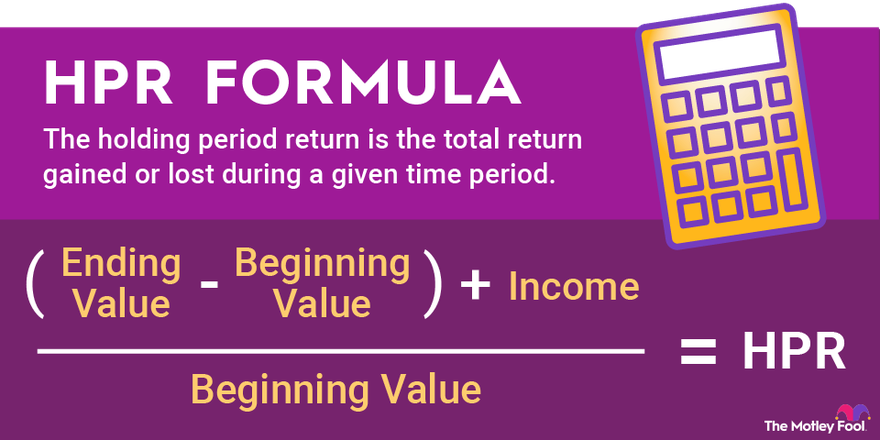

How To Calculate Holding Period Return

If a company has a debt to equity of.

. So the debt to equity of. 1 day agoHDFC Retirement Savings Fund Equity Plan has given an impressive return of 2545 in the last three years under the direct plan. Total assets 500000.

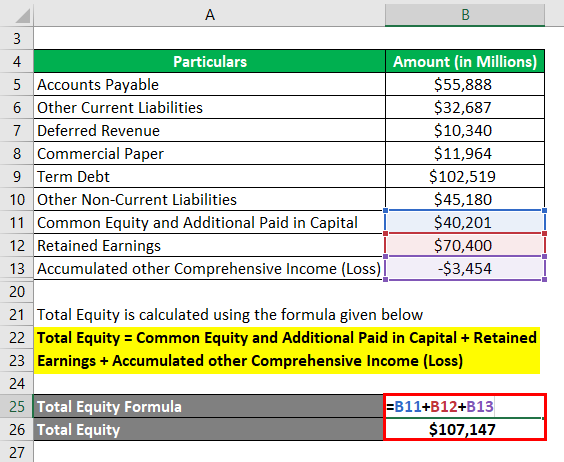

Credit card debt. The cost of the external equity is equal to the current total equity minus the targeted equity. In other words it is calculated by dividing a companys total liabilities by its shareholder equity.

It is an important metric as it indicates how the company is. Examples of liabilities include accounts payable long term debt short term debt capital lease obligation other current liabilities etc. So the debt to equity of Youth Company is 025.

The Debt to Equity Ratio Calculator calculates the debt to equity ratio of a company instantly. In comparison the average home equity loan rate is just 596 and the average interest rate for a home. What is a Debt-to-Income Ratio.

10000000 8000000 125 debt-to-equity ratio. Below is the debt to equity ratio calculator. Lets consider that an online based business has the following financial position.

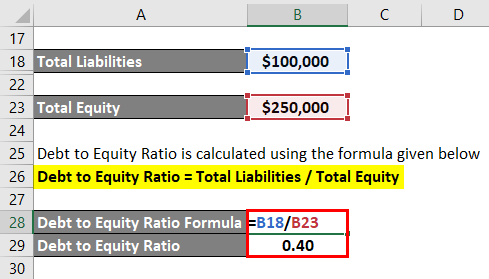

The equity ratio that results is 200000 500000 040 or 4000. Debt to equity ratio total liabilities stockholders equity. If a companys total liabilities are 10000000 and its shareholders equity is 8000000 the debt-to-equity ratio is calculated as follows.

A high debt to equity ratio is considered anything over 15 which may indicate that the company is experiencing financial difficulties. Using a home equity product to pay off a high-interest credit card could save you quite a bit of interest. In a normal situation a ratio of 21 is considered healthy.

Dont Settle For Just One Offer Compare Home Equity Rates And Find Your Lowest Instantly. Debt-to-income ratio DTI is the ratio of total debt payments divided by gross income before tax expressed as a percentage usually on either a monthly or annual basis. Total owners equity 200000.

The debt to equity ratio is used to calculate how much leverage a company is using to finance the company. Debt to Equity Ratio in Practice. It is a measure of the companys leverage and in general only debt portion is considered in liabilities.

According to the Federal Reserve the average credit card interest rate for cards assessed interest is 1665 APR. This is an online debt to equity ratio calculatorThe debt-to-equity ratio DE is a financial ratio indicating the relative proportion of shareholders equity and debt used to finance a companys assets. Debt equity ratio Total liabilities Total shareholders equity 160000 640000 ¼ 025.

A high debt to equity ratio is considered anything over 15 which may indicate that the company is experiencing financial difficulties. If they had no debt. Debt to Equity Ratio Calculator.

If a company is trying to seek 11 million in equity then subtract 1 million from 11 million to get 100000. Gather the most recent statement for each debt - such as credit cards car and boat loans and home equity loans - you want to include in your payment plan. This number may be much higher in some industries as the industry needs more debt to finance investment.

The Debt to Equity Ratio or Indebtedness as it is often known is a financial metric that indicates the relative proportion of liabilities and shareholder equity in the company. These figures are available on the balance sheet. From a generic perspective Youth Company could use a little more external financing and it will also help them access the benefits.

Simply enter in the companys total debt and total equity and click on the calculate button to start. It is currently the top performer in its category in terms of. The debt-to-equity ratio is calculated as follows.

Ad Use LendingTrees Marketplace To Find The Best Home Equity Loan Option For You. The formula for debt to equity ratio can be derived by using the following steps. The amount of 100000 is the external equity you need the cost of external equity calculator for finding the external.

As a quick example if someones monthly income is 1000 and they spend 480 on debt each month their DTI ratio is 48. DebtEquity DE Ratio calculated by dividing a companys total liabilities by its stockholders equity is a debt ratio used to measure a companys financial. Here is how the Debt to Equity Ratio calculation can be explained with given input values - 3750833 45010120100.

Find the following items on your. This ratio is commonly stated as a number such as 15 or 065. Stockholders equity this indicator is determined by subtracting liabilities from the total of a companys assets and represents the companys book value.

Example of an equity ratio calculation. Debt to Equity Ratio Total Liabilities Shareholders Equity.

Debt To Equity Ratio Formula Calculator Examples With Excel Template

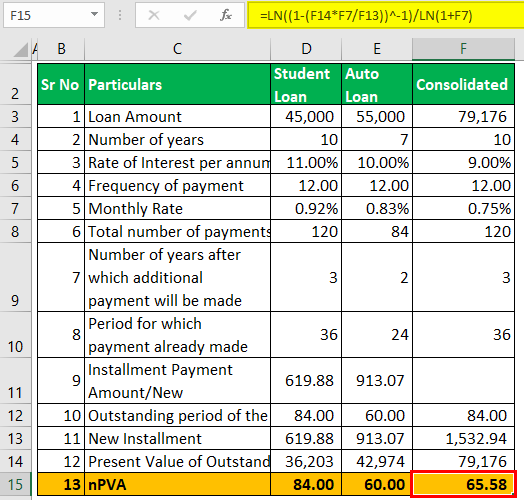

Consolidation Loan Calculator Clearance 51 Off Www Ingeniovirtual Com

Nice Write Properly Your Accomplishments In College Application Resume

What Are Some Common Uses For A Laptop Or Desktop Computer Quora

Debt To Equity Ratio Formula Calculator Examples With Excel Template

Ex 99 2

Debt To Equity Ratio Formula Calculator Examples With Excel Template

Debt To Equity Ratio Formula Calculator Examples With Excel Template

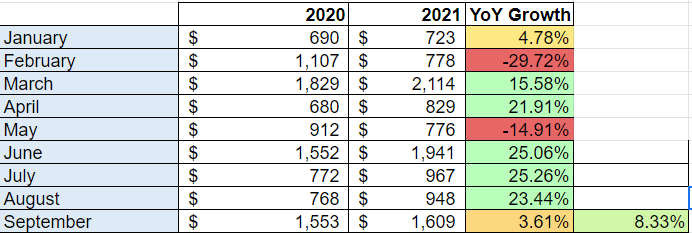

My Dividend Growth Portfolio Q3 Update 30 Holdings 11 Buys And 2 Sells Seeking Alpha

Weighted Average Cost Of Capital Formula

Debt To Equity Ratio Formula Calculator Examples With Excel Template

To What Extent Or Percentage Of Our Salary We Should Invest Through Sip Quora

How I Earn Over 10 Passive Income With P2p Lending

Debt To Equity Ratio Formula Calculator Examples With Excel Template

Weighted Average Cost Of Capital Formula

Calculating Diluted Earnings Per Share

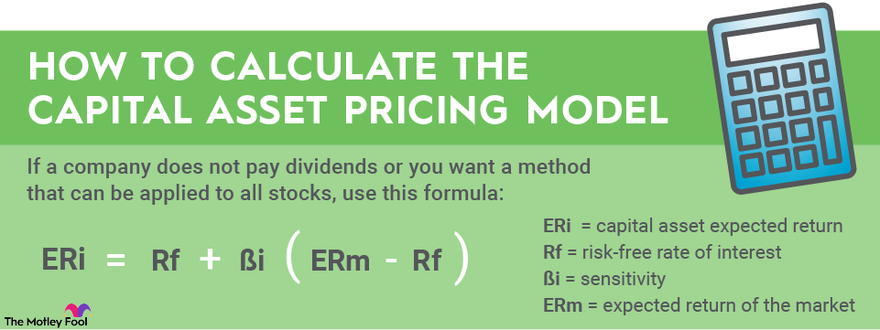

How To Calculate Holding Period Return